Week in Review

In This Edition:

Markets Lifted by Fed Cut Hopes

US equities rose as investors priced in a near-certain September Fed rate cut, with mixed inflation data and resilient consumer demand balancing lingering cost pressures.

UK GDP surprised to the upside while eurozone growth stalled, with Germany’s investor confidence weakening and Norway’s central bank signalling possible future cuts.

China Slows, Japan Outperforms

China’s weak economic data and property slump reinforced calls for fiscal support, while Japan’s stronger-than-expected GDP and firm price pressures boosted expectations of a Bank of Japan rate hike.

Risks from Ukraine War and Russia Sanctions

Ukraine rejected Russian territorial demands as Moscow’s financial sector showed mounting strain from sanctions, with VTB reporting a sharp profit collapse.

Labour Fragility vs. Equity Market Strength

South Africa’s unemployment ticked higher despite strong manufacturing output, while the JSE All Share advanced on financials and industrials, even as resource stocks pulled back.

Markets Lifted by Fed Cut Hopes

US markets ended last week stronger, lifted by growing confidence that the Federal Reserve is edging closer to interest rate cuts. The S&P 500 and Nasdaq touched fresh records midweek before easing into Friday, while the Dow also advanced. Gains reflected optimism that softer headline inflation, resilient consumer demand, and labour-market stability could allow the Fed to start easing policy, even as underlying price pressures remain sticky. Futures now price nearly 90% odds of a September rate cut, with Chair Jerome Powell’s Jackson Hole speech later this month expected to give clearer policy guidance.

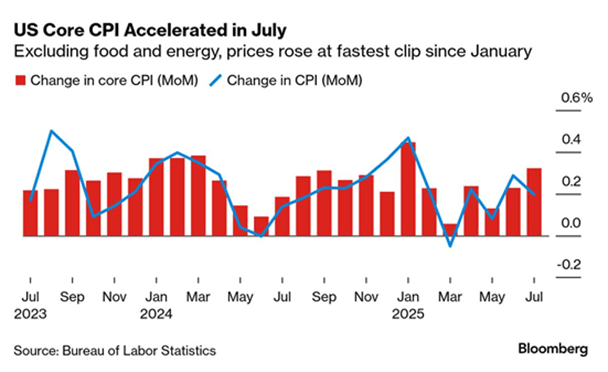

US inflation data was mixed. Headline CPI slowed to 0.2% in July, helped by lower energy and grocery prices, but core CPI rose 0.3% – its fastest pace this year. Producer prices also jumped 0.9%, the biggest increase in three years, keeping inflation concerns alive. On the positive side, retail sales rose 0.5% and jobless claims declined, pointing to resilience in household spending and employment. Still, consumer sentiment dipped as inflation worries resurfaced, highlighting the challenge the Fed faces in balancing growth with price stability.

Growth Divergence Persists

In the UK, GDP growth surprised on the upside, with the economy expanding 0.4% in June and 0.3% for the second quarter, ahead of expectations but slower than earlier in the year. The labour market cooled slightly but remained stable – unemployment held at 4.7% while wage growth slowed. Retail sales softened and housing sentiment weakened further, pointing to pressure on households. Across Europe, momentum slowed as eurozone GDP barely grew (0.1% in Q2), industrial production fell, and investor confidence – particularly in Germany – dropped sharply. Norway’s central bank kept rates unchanged at 4.25% but signalled the possibility of further cuts later this year.

China Slows, Japan Outperforms

China’s data showed clear signs of slowing momentum. Industrial production, retail sales, and investment all missed expectations, while the property market weakened further with home prices down 2.8%. Household loan demand contracted, inflation was flat, and producer prices fell for the 34th straight month, underscoring persistent deflationary pressures. A 90-day extension on US-China tariff talks provided a short-term lift to sentiment, but weak data reinforced expectations that Beijing will need to ramp up fiscal support to stabilise growth.

Japan was a positive outlier. GDP expanded at an annualised 1.0% in the second quarter, well above forecasts, supported by stronger exports, resilient investment, and firmer consumer spending. Producer prices rose 2.6% year-on-year, adding to evidence of cost pressures. The yen strengthened and 10-year government bond yields climbed, as markets increasingly expect the Bank of Japan could raise rates later this year or in early 2026.

Risks from Ukraine War and Russia Sanctions

Geopolitical risks also remained in focus. Ukraine’s President Zelenskiy rejected Russian demands to cede the Donbas region ahead of US-Russia talks, while Russia’s banking sector came under renewed strain. State-owned VTB reported a near 50% collapse in lending profits, reflecting the heavy toll of sanctions and war financing.

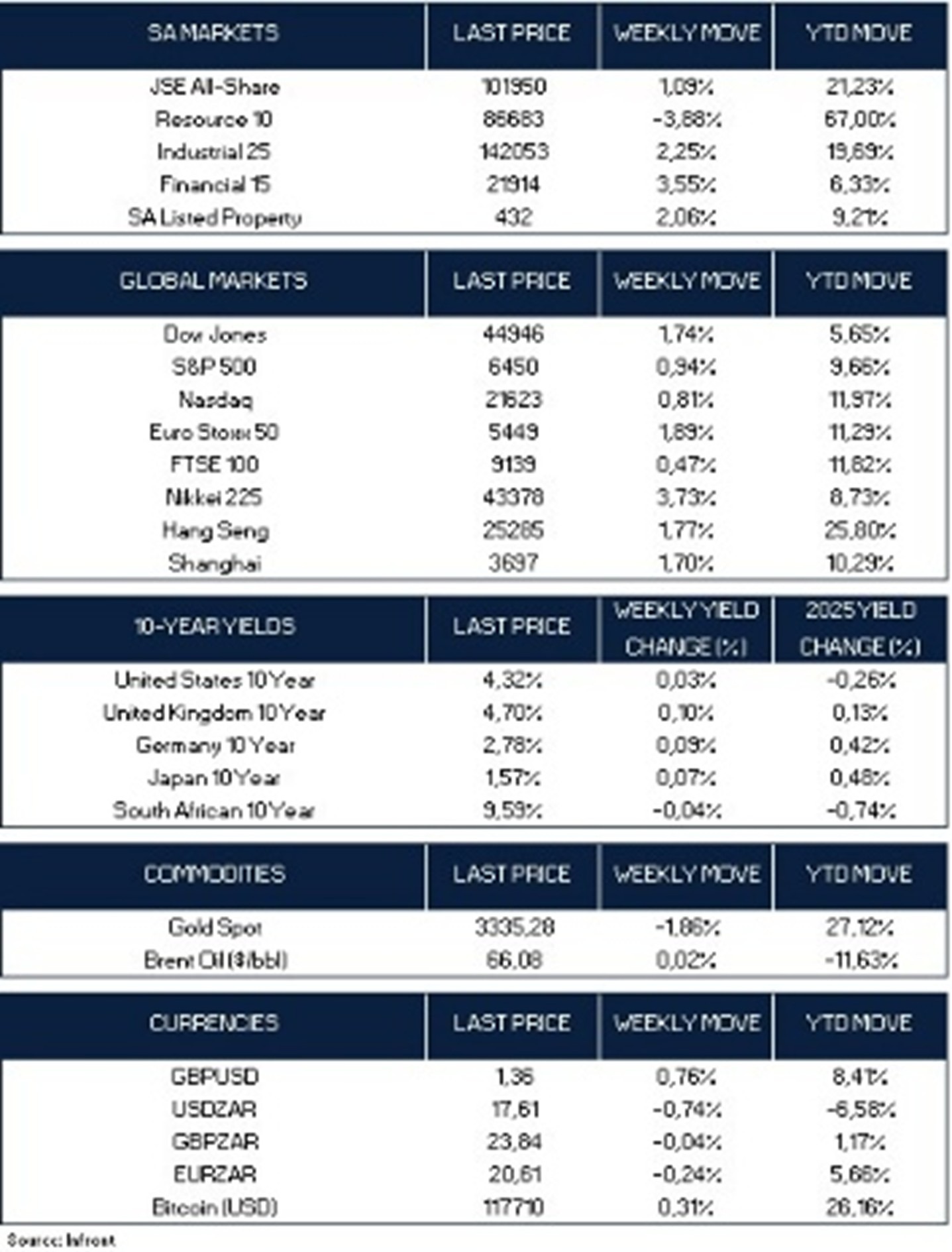

Global equities advanced the previous week, with most major indices ending higher. In the US, the Dow Jones gained 1.74%, while the S&P 500 and Nasdaq added 0.94% and 0.81% respectively. European markets were firmer, with the Euro Stoxx 50 rising 1.89% and the FTSE 100 up 0.47%. In Asia, sentiment was buoyant: Japan’s Nikkei jumped 3.73%, Hong Kong’s Hang Seng rose 1.77%, and China’s Shanghai Composite advanced 1.70%.

Labour Fragility vs. Equity Market Strength

South Africa’s unemployment rate edged higher in Q2, rising to 33.2% from 32.9% in Q1, underlining the fragility of the labour market. Manufacturing offered a bright spot, with output up 1.9% year-on-year in June, ahead of expectations and stronger than May’s 0.7% increase. Retail sales were weaker, rising just 1.6% year-on-year, with gains in textiles and clothing offset by declines at general dealers.

On the corporate front, ArcelorMittal South Africa remained in focus as government and the IDC held crisis talks over the future of its Newcastle mill. Without a resolution, the facility could close by 30 September, putting 3,500 direct jobs at risk and affecting industries reliant on its steel. Meanwhile, government announced plans for a $569 million credit-guarantee vehicle to support private infrastructure investment, with R2 billion in equity funding committed by the state.

South Africa’s government also rejected a US administration report that criticised the country’s human rights record, describing it as inaccurate and unreflective of South Africa’s constitutional democracy.

The JSE All Share Index gained 1.09% over the last week, lifting year-to-date returns to 21.23%. Financials led the advance, climbing 3.55%, while industrials gained 2.25% and property added 2.06%. Resources pulled back 3.88% but remain the standout performer this year with a 67% gain. Despite headwinds, local equities continue to deliver strong returns in 2025.

July’s US CPI came in at 2.7%, in line with expectations and helped by lower petrol prices, but core inflation rose to 3.1% – the highest since February -driven by services. Producer prices also recorded their biggest rise in three years, highlighting ongoing cost pressures. Still, the data was less severe than feared and, alongside softer labour-market signals, pushed market odds of a September Fed rate cut above 90%. Source: Bloomberg