Week in Review

In This Edition:

Rate Cuts, Strong Data, and Market Highs

The U.S. balanced fresh monetary easing with strong consumer spending and buoyant financial markets.

U.S. and China Re-engage

U.S.-China relations showed tentative stabilisation with progress on trade, technology, and diplomacy.

BoE Holds Steady Amid Inflation Pressures

The UK maintained a cautious monetary stance while European equities delivered mixed results.

Diverging Paths in Japan and China

Asia reflected policy shifts in Japan and slowing momentum in China, driving divergent market outcomes.

Oil Slips, Gold Climbs

Commodity markets diverged as investors weighed weaker oil demand against safe-haven demand for gold.

Policy Pause and Market Strength

South Africa balanced cooling inflation and weaker manufacturing against resilient financial markets.

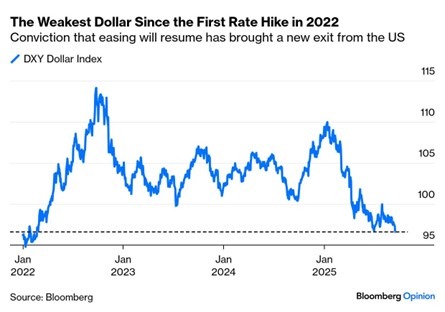

Dollar Weakness Eases Conditions

A softer dollar provided relief to global borrowers.

Market Moves & Chart of the Week

Rate Cuts, Strong Data, and Market Highs

The Federal Reserve lowered rates by 25 basis points on Wednesday, as widely expected, and indicated it may cut by a further 50 basis points before year-end. Policymakers flagged rising downside risks to employment, even as inflation remains elevated. Governor Stephen Miran, newly appointed to the Board, was the lone dissenter, preferring a larger 50-basis-point reduction. Chair Jerome Powell framed the move as a risk-management measure to pre-empt further labour market softening.

In other economic news, U.S. retail sales jumped 0.6% in August, surpassing expectations, while core sales climbed 0.7%, also beating forecasts. July figures were revised higher, showing 0.6% growth instead of the initially reported 0.5%. Despite signs of a softer labour market, economic activity appears to remain resilient.

U.S. and China Re-engage

President Trump and Chinese President Xi Jinping spoke by phone on Friday. Chinese state media described the talks as “pragmatic and constructive.” Xi emphasised the importance of US-China relations, urged Washington to avoid unilateral trade actions, and expressed support for a TikTok resolution that separates its U.S. operations from its Chinese parent. Trump said on social media that the TikTok deal was approved and progress was made on trade, fentanyl, and the Russia-Ukraine conflict. The leaders are set to meet at the APEC Summit in late October, with Trump planning a visit to China in early 2026.

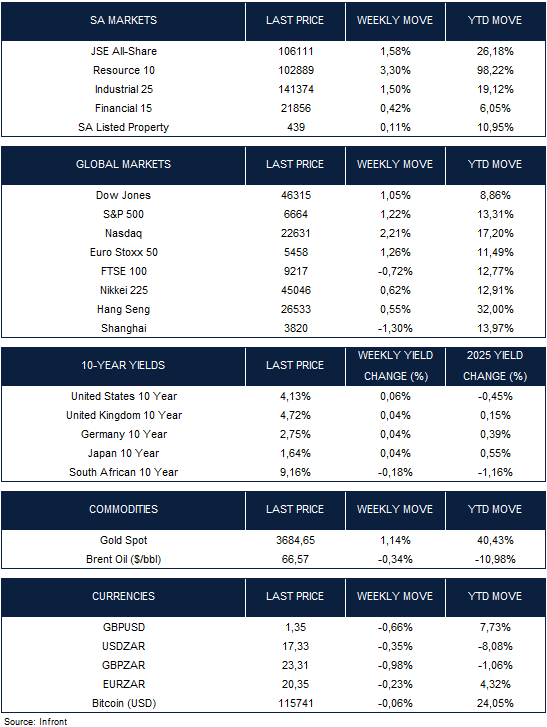

Major U.S. stock indexes hit record highs during last week. The Nasdaq Composite advanced 2.21%, while the S&P 500 and Dow Jones Industrial Average gained 1.22% and 1.05%, respectively. Meanwhile, the yield on the U.S. 10-year Treasury note rose 6 basis points to 4.13%.

BoE Holds Steady Amid Inflation Pressures

The Bank of England last week held its key rate at 4% in a 7–2 vote and slowed bond sales to ease gilt market pressures amid rising long-term yields. Governor Andrew Bailey said that while inflation is expected to return to the 2% target, any future rate cuts will need to be gradual and cautious. Economic data showed headline inflation steady at 3.8% in August, overall wage growth rising to 4.7% and unemployment holding at 4.7%. On the market front, the FTSE 100 fell 0.72% week-on-week, while Europe’s Euro Stoxx 50 gained 1.26%.

Diverging Paths in Japan and China

Japan’s stock market edged higher last week, with the Nikkei 225 rising 0.62%. The Bank of Japan surprised markets by announcing it would start selling its ETF and REIT holdings sooner than expected, signalling a shift toward policy normalisation. As widely expected, interest rates were kept at 0.50%, though two policymakers broke from consensus, favouring a hike amid ongoing political and trade uncertainties.

Mainland Chinese stocks fell as investors booked profits amid signs of slowing growth. The Shanghai Composite fell 1.3%, while Hong Kong’s Hang Seng rose 0.55%. August data showed retail sales and industrial output posting their weakest monthly growth this year, with fixed asset investment slowing to just 0.5% for the first eight months, the lowest non-pandemic reading on record.

Policy Pause and Market Strength

The South African Reserve Bank paused its rate-cutting cycle on Thursday, leaving the benchmark repo rate unchanged at 7%, following a split 4-2 vote, with two dissenting members in favour of a 25-basis point cut. This decision aligned with market expectations. The bank’s updated forecasts were slightly more hawkish, revising the 2026 inflation projection from 3.3% to 3.6%, driven by supply-side factors such as food and fuel prices, as well as higher electricity tariffs. The Monetary Policy Committee (MPC) highlighted that it is closely monitoring the effects of the 125 basis points of rate cuts implemented over the past year, along with shifts in inflation expectations and associated risks, before considering any further easing.

South African (SA) inflation slowed more than expected in August, driven by lower fuel and food costs. Headline consumer inflation fell to 3.3% y/y from 3.5% in July, lower than the 3.6% forecast of economists polled by Reuters. The annual core inflation rate, which excludes food, non-alcoholic beverages, fuel, and energy, rose to 3.1% in August 2025, the highest since March, from 3% in the prior month.

Dollar Weakness Eases Conditions

SA’s manufacturing sector slipped back into contraction in August, with the Absa PMI falling 1.4 points to 49.5 after briefly entering expansion in July. Compiled by the Bureau for Economic Research (BER), the index highlights weak domestic and export demand, as new sales orders dropped sharply to 47.4, with respondents citing the adverse effects of U.S. tariffs on exports.

The All-Share Index rose 1.58% last week, boosted by Resources and Industrials. The local currency strengthened against the U.S. dollar, moving to R17.33/$ from the previous week’s R17.39/$ level. The 10-year SA government bond extended its year-to-date rally, with yields falling 18 basis points over the week.