Week in Review

In This Edition:

Weak Jobs Data Fuels Fed Rate Cut Bets

US job growth slowed sharply in August, pushing unemployment to 4.3% and increasing expectations of imminent Federal Reserve rate cuts.

Growth Concerns Amid Stable Inflation

European stocks fell as global slowdown fears weighed, while Eurozone inflation edged to 2.1% and unemployment improved slightly.

Trade Deal Boosts Stocks

Japanese equities advanced, led by automakers, as a US–Japan trade deal capped tariffs on goods including automobiles.

Oil Weakness, Gold Strength

Oil prices fell on supply concerns and rising US stockpiles, while gold had its best week in three months on Fed cut expectations.

Week Ahead – Inflation and ECB in Focus

Markets await US inflation data, expected to show price pressures persisting, and the ECB’s policy meeting, where rates are likely to stay on hold.

Reserves Strength and Corporate Turnaround

Rising reserves and a weaker dollar boosted the rand, bonds, and equities, while Transnet reported revenue growth and narrower losses despite ongoing financial challenges.

Weak Jobs Data Fuels Fed Rate Cut Bets

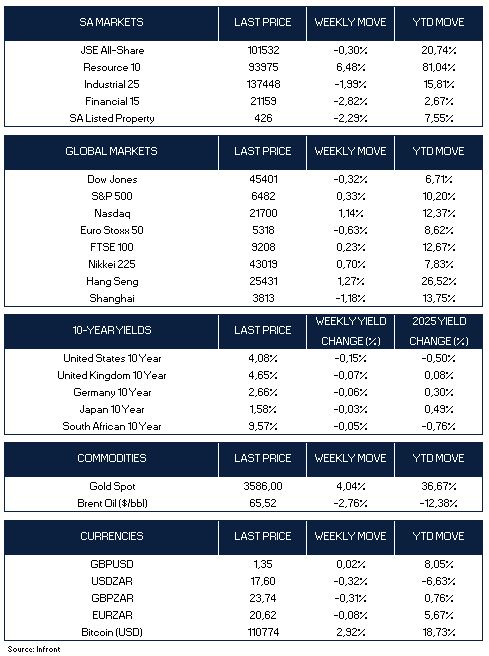

US stocks closed lower on Friday as weaker-than-expected August jobs data fuelled concerns about a slowing economy, despite growing expectations for Federal Reserve rate cuts. The S&P 500, which had gained earlier in the session, finished 0.3% lower, retreating from Thursday’s record close. The Dow Jones Industrial Average dropped 220 points, while the Nasdaq 100 remained essentially flat. Sectors such as banks, energy, and industrials led the decline, while real estate showed resilience, buoyed by optimism surrounding potential rate cuts.

Despite Friday’s losses, both the S&P 500 and the tech-heavy Nasdaq posted gains for the week, up 0.33% and 1.14%, respectively. The Dow, however, finished the week down 0.32%.

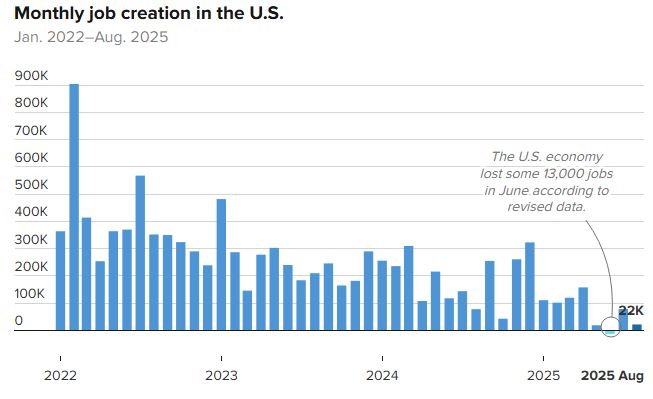

The catalyst for the sell-off was the release of the Labor Department’s nonfarm payrolls report, which showed US employers added just 22,000 jobs in August. This was a sharp decline from July’s revised figure of 79,000 and well below market expectations of approximately 77,000. Additionally, June’s payroll number was revised downward from a gain of 14,000 to a loss of 13,000, marking the first negative monthly reading since December 2020. The unemployment rate for August also ticked up to 4.3%, the highest level since 2021.

In response to the jobs report, futures markets tracked by the CME FedWatch tool now reflect a 100% probability of at least a 25-basis-point (0.25 percentage point) rate cut at the Fed’s next meeting. The likelihood of a 50-basis-point cut increased from 0% to roughly 10% following the data. Meanwhile, the yield on the 10-year US Treasury note fell sharply to 4.07%, its lowest level in five months, as investors sought the relative safety of government bonds amid concerns over a weakening labour market.

Growth Concerns Amid Stable Inflation

In Europe, the STOXX Europe 50 Index ended the week 0.63% lower, weighed down by worries about slowing global growth and a strengthening euro. Inflation in the Eurozone rose slightly in August to 2.1%, remaining close to the European Central Bank’s (ECB) 2% medium-term target. Unemployment in the bloc fell marginally to 6.2% in July, down from 6.3%. Meanwhile, in contrast the UK’s FTSE 100 Index posted a modest gain of 0.23%.

Trade Deal Boosts Stocks

Japanese stock markets saw positive momentum for the week, with the Nikkei 225 Index gaining 0.70%. Japanese auto stocks were particularly strong, as the US formally implemented a trade deal with Japan, capping tariffs on most Japanese goods, including automobiles, at 15%.

Mainland Chinese markets, however, experienced a pullback, with the Shanghai Composite Index falling 1.18% as investors took profits following a recent rally. In Hong Kong, the Hang Seng Index fared better, rising 1.27%.

Oil Weakness, Gold Strength

On the commodities front, oil prices continued their decline for a third consecutive session on Friday, heading for a weekly loss—the first in three weeks. Concerns over OPEC+ supply expectations and a surprise increase in US crude stockpiles contributed to the bearish sentiment. Gold, on the other hand, was on track for its best week in three months, gaining over 4% on the week, as expectations for a potential US interest rate cut supported the precious metal’s appeal.

Inflation and ECB in Focus

Looking to the week ahead, key economic releases will include the US inflation data for August, with headline consumer inflation expected to rise to 2.9%, the highest level since January. The core inflation rate is expected to remain above 3%, signalling ongoing price pressures.

In Europe, all eyes will be on the European Central Bank’s upcoming monetary policy decision. The ECB is widely expected to keep borrowing costs unchanged for a second consecutive meeting, with the deposit rate remaining at 2%, as inflation remains near target and economic growth shows signs of steadying.

Reserves Strength and Corporate Turnaround

South Africa’s net foreign reserves rose to $65.899 billion at the end of August, up from $65.143 billion in July, surpassing expectations. This positive data, coupled with a weaker dollar, provided a lift to the South African rand, stocks, and government bonds on Friday. As the US dollar weakened against a basket of major currencies, investor sentiment towards emerging markets, including South Africa, was notably improved.

In corporate news, South African freight rail and ports company Transnet reported a smaller loss for the last financial year, signalling progress in its ongoing turnaround program. Transnet’s revenue grew by 7.8% to 82.7 billion rand, while net operating expenses fell by 4.9% to 52.1 billion rand. The company emphasized that increasing private-sector involvement in the country’s ports and rail network remains a central element of its long-term strategy. However, Transnet’s auditor reiterated concerns about the company’s financial viability, cautioning that challenges remain.

On the Johannesburg Stock Exchange, the JSE All Share Index ended the week 0.3% softer, the resource sector continued its positive performance, buoyed by increases in the gold price, while the other major sectors were down on the week. Meanwhile, South Africa’s benchmark 2035 government bond saw a gain in early trading, with the yield falling by 8 basis points to end the week at 9.565%.

Gabriel Cortes / CNBC : Source U.S. Bureau of Labor Statistics via FRED:

Nonfarm payrolls rose by only 22,000 in the U.S. in August, while the unemployment rate edged up to 4.3%, the Bureau of Labor Statistics reported on Friday. That fell well short of the 75,000 increase expected by economists surveyed by Dow Jones. The report showed a marked slowdown from the July increase of 79,000, which was revised up by 6,000. Revisions also showed a net loss of 13,000 in June. The report comes as markets widely expect the Fed to lower its benchmark interest rate by a quarter percentage point when it releases its next decision Sept. 17.