Week in Review

In This Edition:

Record Highs Amid Sticky Inflation and Softer Jobs

U.S. equities hit record highs as weak labour data and persistent inflation kept markets confident of upcoming Fed rate cuts.

ECB Steady, Growth Forecasts Lifted, Political Shifts

The ECB held rates at 2% but raised inflation and growth forecasts, while UK GDP stagnated and France faced renewed political uncertainty.

Japan Surges on AI, China Struggles with Deflation

Japan’s Nikkei reached record highs on AI-driven optimism and stronger GDP, while China battled deflation despite a rally in tech stocks.

Gains Amid Heightened Tensions

Equities, commodities, and Bitcoin advanced globally, though Trump’s tariff threats and NATO’s clash with Russian drones highlighted rising geopolitical risks.

Growth Recovery and Market Strength

South Africa’s economy rebounded in Q2 with stronger consumption, digital retail growth, secured U.S. fisheries exports, rising equities, and a firmer rand.

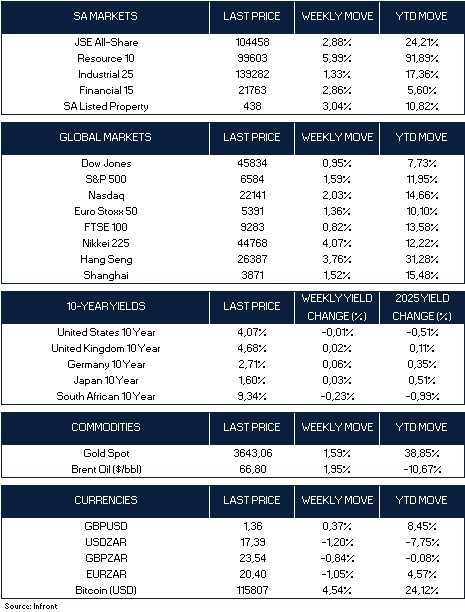

Market Moves of the Week

Chart of the Week

Record Highs Amid Sticky Inflation and Softer Jobs

U.S. equities closed higher, with the Dow, S&P 500, and Nasdaq all hitting fresh record highs before easing modestly into Friday. The Russell 2000 extended its winning streak to six weeks, supported by optimism around artificial intelligence and expectations that the Federal Reserve will cut rates at its September 16–17 meeting. Futures markets continue to price in a faster pace of U.S. interest rate cuts than the Fed’s own projections.

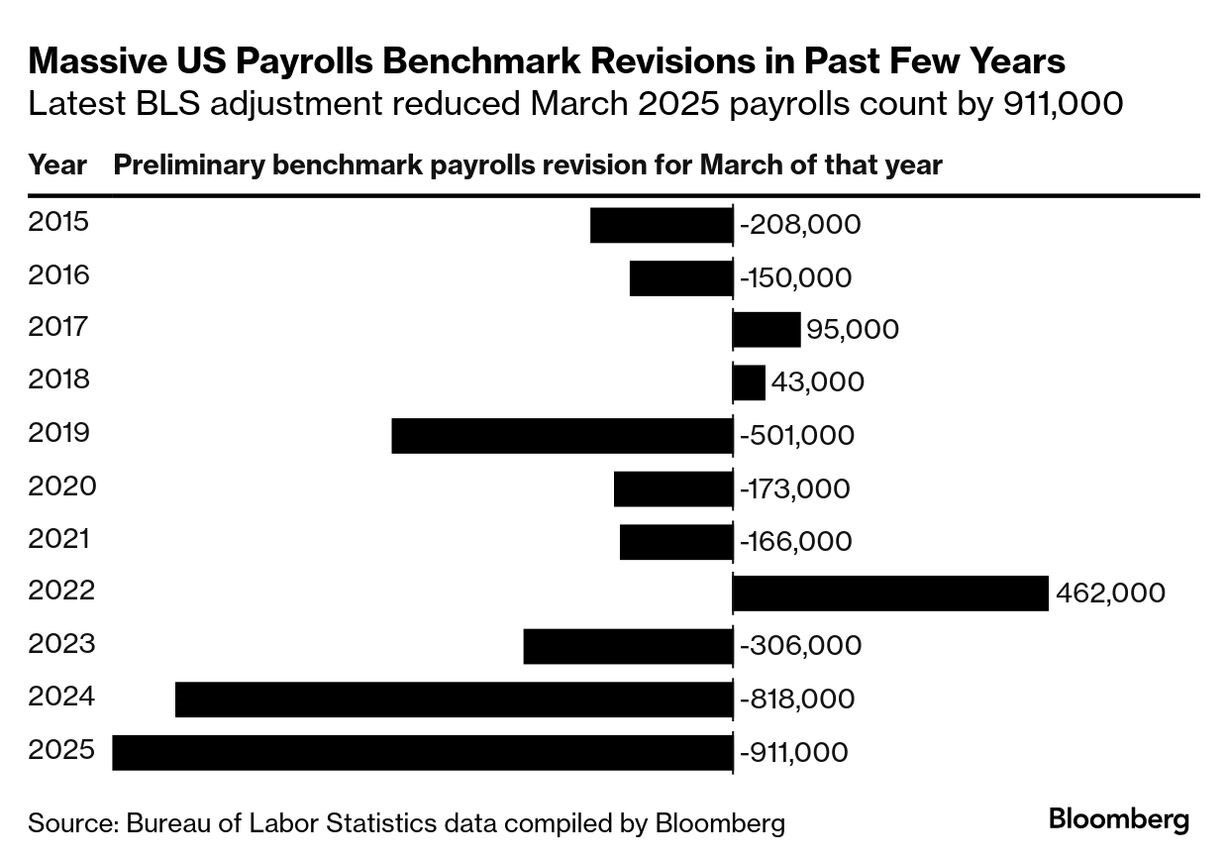

Economic data kept focus on inflation and the labour market. August CPI rose 2.9% year-on-year, with core CPI steady at 3.1%. Treasury yields dipped as investors priced in Fed action, with the 10-year briefly touching 4.0%. Jobless claims rose to their highest since 2021 and payrolls were revised down by 911,000 – the largest downward revision on record – pointing to a softer jobs backdrop. Consumer sentiment also slipped, with households worried about business conditions and employment, while long-term inflation expectations edged up.

ECB Steady, Growth Forecasts Lifted, Political Shifts

In Europe, the ECB left rates unchanged at 2% but lifted its 2025 inflation and growth forecasts, prompting markets to assume that interest rate cuts are over in the region. German data was mixed, with exports down and factory orders weaker, though output improved. In the UK, GDP was flat in July, retail sales were firmer, but the housing market softened further. Political uncertainty persisted in France after President Macron appointed Sebastien Lecornu as prime minister following the collapse of François Bayrou’s government.

Japan Surges on AI, China Struggles with Deflation

Japan was a standout, with the Nikkei jumping 4.1% to a record high on AI-driven gains led by SoftBank. GDP was revised sharply higher, showing 2.2% annualised growth in Q2, supported by consumption. Prime Minister Shigeru Ishiba announced his resignation, with a new leader to be chosen in October. Inflation pressures remain, with widespread consumer price hikes, though PPI eased slightly. The Bank of Japan is expected to hold steady this month, but another hike remains possible.

China’s deflation persisted, with CPI falling 0.4% year-on-year and PPI down 2.9%. Core CPI, however, rose to an 18-month high of 0.9%, suggesting some policy traction. Equities rallied strongly, driven by liquidity and optimism over Beijing’s push for homegrown technology, with the CSI 300 seeing its best daily gain since March. This divergence between weak price data and buoyant markets highlights the challenge for policymakers.

Gains Amid Heightened Tensions

Geopolitics stayed in focus. Donald Trump threatened tariffs of up to 100% on China and India unless the EU joined in, while the U.S. was shaken by the assassination of conservative activist Charlie Kirk. In Europe, Poland shot down Russian drones that crossed its airspace, the first direct NATO engagement of the war. Germany pledged more air policing, while Trump suggested the incursion may have been a “mistake,” exposing divisions among allies.

Global markets ended last week broadly higher. The Dow gained 0.95%, the S&P 500 rose 1.59%, and the Nasdaq climbed 2.03%. In Europe, the Euro Stoxx 50 advanced 1.36% and the FTSE 100 gained 0.82%. In Asia, Japan’s Nikkei jumped 4.07%, Hong Kong’s Hang Seng rose 3.76%, and the Shanghai Composite added 1.52%. Bond markets were stable overall, with U.S. 10-year yields easing slightly, while German and Japanese yields edged up. Commodities were firmer, as gold rose 1.6% and Brent crude 2.0% to $66.80. Bitcoin gained 4.5% for last week.

Growth Recovery and Market Strength

South Africa’s economy showed signs of recovery in Q2 2025, with real GDP expanding 0.8% quarter-on-quarter, up from just 0.1% in Q1 and above expectations. Growth was broad-based, with manufacturing, mining, and trade contributing, while stronger household consumption added support. Year-on-year, GDP rose 0.6%, but the current account deficit widened to R82.8bn (1.1% of GDP) as the trade surplus narrowed on softer exports.

Momentum in manufacturing slipped in July, with output down 0.5% month-on-month and 0.7% year-on-year, while the BER Building Confidence Index eased to 35 in Q3. Weaker sentiment among architects, surveyors and material producers outweighed modest gains for contractors, highlighting the uneven nature of the recovery.

Retail trends were mixed, but online sales are expected to exceed R130bn in 2025, or around 10% of total turnover, after surging 35% in 2024. Growth remains strongest in on-demand grocery platforms such as Shoprite, Pick n Pay and Woolworths, while digital investment is reshaping fashion retail.

In trade, South Africa secured continued access to the U.S. for fisheries exports beyond January 2026, after regulators recognised local marine mammal protections as comparable to U.S. standards. The ruling safeguards jobs, sustains a vital export channel, and underscores the country’s role as a responsible fishing nation.

South African equities advanced, with the JSE All Share Index rising 2.88%. Resource stocks were the standout performers, surging 5.99%, while financials gained 2.86% and industrials added 1.33%. Listed property also firmed, up 3.04%. The rand strengthened against the U.S. dollar, appreciating 1.20% to close at R17.39, supported by improved risk sentiment.

The Bureau of Labor Statistics cut payroll estimates for the year to March 2025 by 911,000 jobs—the largest downward revision on record. This equates to roughly 76,000 fewer jobs per month, pointing to a softer labour market than previously reported. Combined with unemployment rising to 4.3%, the data reinforces concerns that U.S. economic momentum is slowing. Source: Bloomberg