Week in Review

|

|

Inflation and Growth Data Weigh on Equities

U.S. equities ended Friday higher but still closed last week in negative territory as investors digested key inflation data. The Federal Reserve’s preferred gauge, the personal consumption expenditures (PCE) price index, rose 0.3% in August, lifting the annual headline rate to 2.7% from 2.6% in July. Core PCE, which excludes food and energy, increased 0.2% for the month and held steady at 2.9% annually, in line with consensus forecasts.

The Bureau of Economic Analysis also revised second-quarter GDP growth to an annualized 3.8%, up from the prior 3.3% estimate, with consumer spending providing the largest boost.

Fed Chair Jerome Powell reiterated last week that while inflation expectations remain anchored near the Fed’s 2% target, downside risks to employment and elevated uncertainty leave policymakers without a “risk-free” policy path. He also noted that tariffs are likely to result in a one-time price adjustment spread over several quarters.

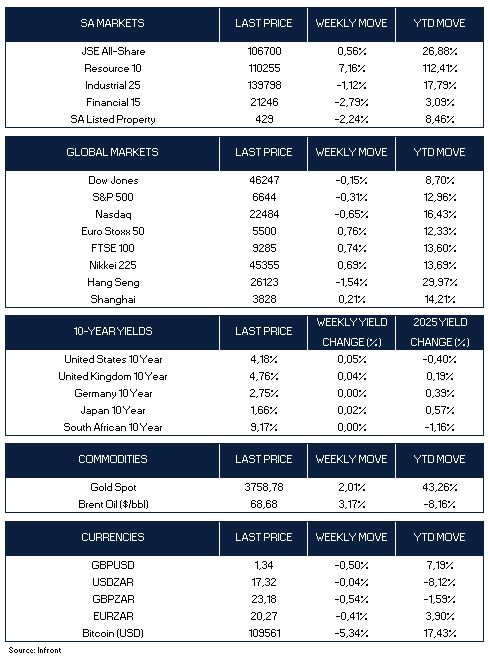

Major U.S. indices ended last week lower, with the Nasdaq Composite and S&P 500 sliding 0.65% and 0.31% respectively, marking each index’s first losing week in four, while the Dow shed 0.15%.

Mixed Economic Signals Amid Modest Growth

In Europe, the STOXX Europe 50 Index rose 0.76%, as markets weighed rate policy developments and ongoing trade tensions. Economic surveys signalled modest growth in the third quarter, with services activity expanding at the fastest pace this year, while manufacturing output lagged. Business confidence dipped to a four-month low.

In the UK, the PMI fell to 51.0, down from 53.5 in August, as both services and manufacturing slowed. Confidence also dropped to its weakest level since June, ahead of the November budget, nevertheless the FTSE 100 gained 0.74% for last week.

Equities Rise Despite Diverging Regional Trends

Japanese equities advanced, with the Nikkei 225 Index up 0.69%. Inflation in the Tokyo area rose 2.5% year-on-year in September, unchanged from August but slightly below expectations. In China, the Shanghai Composite Index gained 0.21%, while Hong Kong’s Hang Seng Index declined 1.54%.

Safe-Haven Demand and Key Economic Releases Ahead

Gold held above $3,750 per ounce, near record highs, supported by safe-haven demand despite a stronger dollar and higher Treasury yields, while oil prices advanced, set for their steepest rise since June, as Ukraine’s strikes on Russian energy infrastructure prompted supply concerns.

The week ahead brings a full slate of economic releases, led by the closely watched U.S. employment report, which will provide fresh insight into payroll growth, unemployment trends, and wage pressures—key indicators shaping the Federal Reserve’s policy outlook. In Europe, attention will centre on new inflation data for the eurozone and its member states, alongside CPI figures from Turkey and Switzerland. On the monetary policy front, interest rate decisions in Australia and India will also be in focus.

Rising Inflation Amid Weakening Confidence

In local news, South Africa’s producer inflation accelerated to 2.1% year-on-year in August, up from 1.5% in July, according to Statistics South Africa. On a monthly basis, the Producer Price Index (PPI) rose 0.3%, with the increase driven largely by higher prices in the food, beverages, and tobacco category, which climbed from 3.9% to 4.3% year-on-year as food inflation reached 4.1%.

Meanwhile, confidence indicators painted a weaker picture. The FNB/BER Consumer Confidence Index dropped sharply in the third quarter, retreating to -13, as households reported worsening financial positions and a weaker economic outlook. Retailer confidence also declined significantly, hitting its lowest level in a year.

In markets, the JSE All Share Index ended last week 0.56% higher, supported by continued strength in resource stocks. The rand firmed in late Friday trade, closing at R17.32 per U.S. dollar.

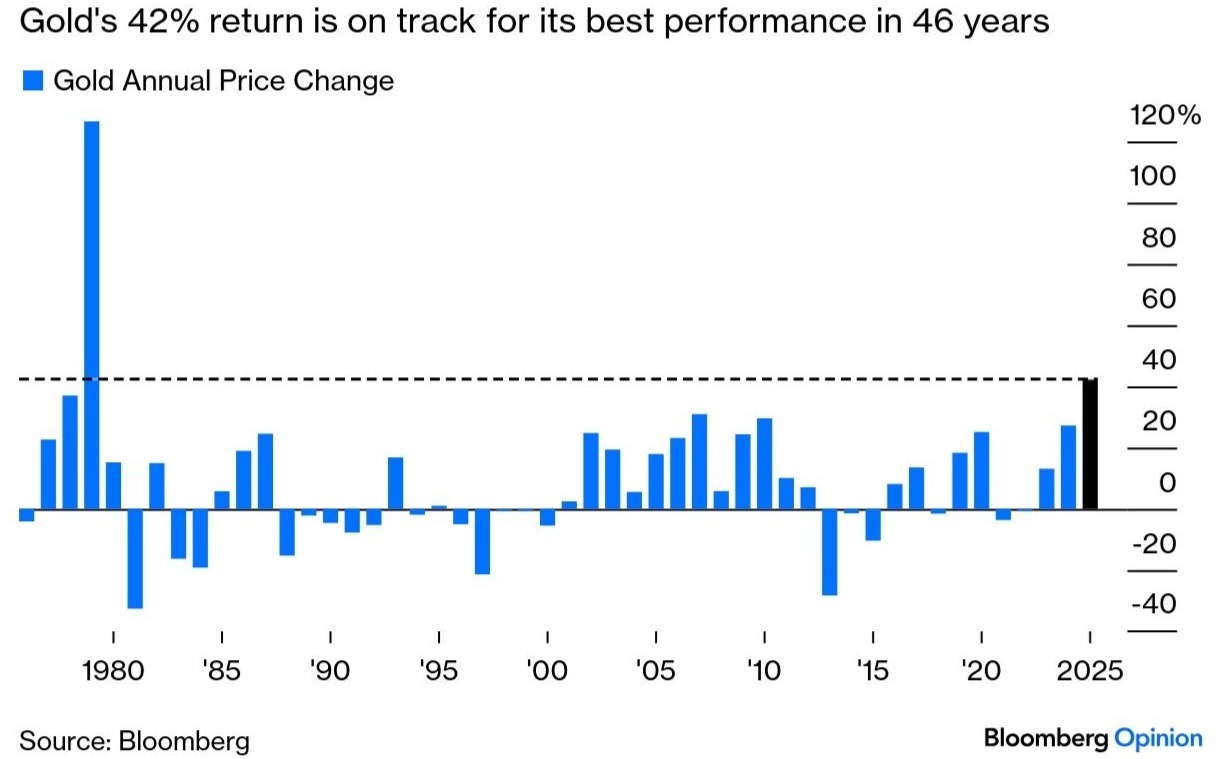

Gold has extended its rally this year, rising more than 40% and on track for its strongest annual performance in over four decades. Not since 1979—when the metal more than doubled amid investor fears that inflation would never abate—has gold experienced such a powerful and sustained surge.