Week in Review

In This Edition:

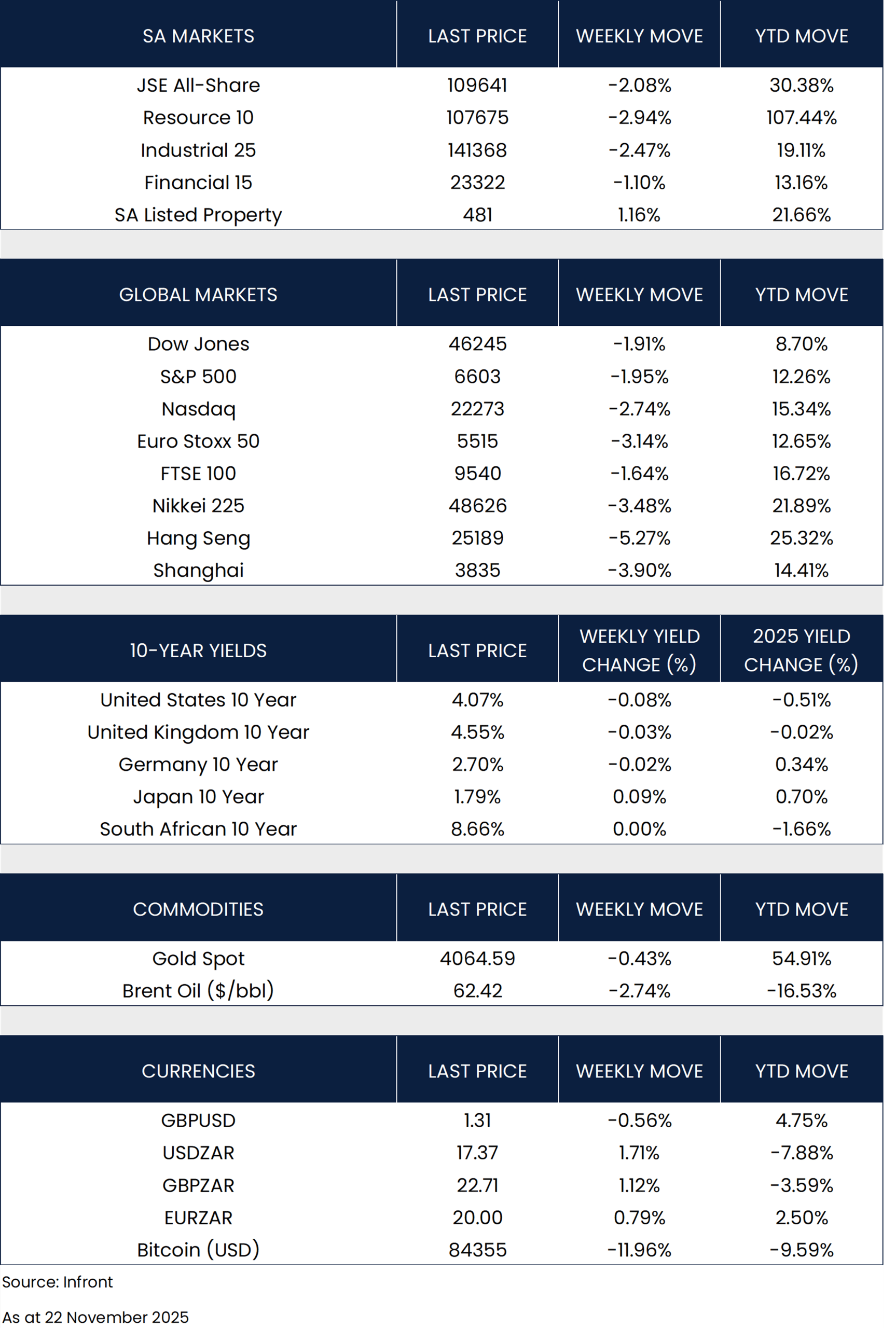

US labour market strengthens despite mixed signals

After a six-week delay due to the government shutdown, the September employment report offered a mixed reading.

Eurozone activity steady as PMI remains in expansion

Early eurozone PMI readings for November indicated that activity continued to expand at a steady pace.

Japan announces stimulus while China weighs support

Japan approved a JPY 21.3 trillion (USD 135 billion) stimulus package, marking progress toward the expansionary fiscal stance anticipated under new Prime Minister Sanae Takaichi.

South African inflation steady as SARB cuts rate

South Africa’s latest CPI print showed inflation holding steady, with headline and core measures remaining broadly aligned with the SARB’s target range.

US labour market strengthens despite mixed signals

After a six-week delay due to the government shutdown, the September employment report offered a mixed reading. Payroll growth came in higher than expected at 119,000, marking an improvement from the subdued hiring seen over the summer. However, the unemployment rate edged up to 4.4%, the highest level in four years. The Bureau of Labor Statistics confirmed that the October report has been cancelled, with the next release, covering November, scheduled for 16 December.

In one of the most closely watched earnings releases of the quarter, NVIDIA reported record revenue that exceeded expectations, supported by strong demand for its AI chips. The company also issued a stronger-than-anticipated Q4 outlook. Markets opened higher on Thursday, but momentum faded later in the session, and NVIDIA ended the week 3.90% lower, as renewed uncertainty around the broader AI theme weighed on major equity indices.

The minutes from the early-November FOMC meeting revealed deeper divisions among policymakers than initially suggested, even after the committee delivered a rate cut earlier in the month. Several members argued that a December cut would be inappropriate and could exacerbate inflation pressures, while most still anticipate a continued easing cycle over time. The Fed also noted that the labour market is expected to soften gradually, with no signs of a sharp deterioration. Political pressure resurfaced as President Trump criticised Chair Jerome Powell as “grossly incompetent” and hinted he has identified a potential replacement ahead of Powell’s term expiry in May.

Despite some supportive earnings releases and economic data, U.S. equities ended last week lower. The Nasdaq Composite fell 2.74%, while the S&P 500 (-1.95%) and Dow Jones (-1.91%) also posted declines.

Eurozone activity steady as PMI remains in expansion

Early eurozone PMI readings for November indicated that activity continued to expand at a steady pace. The HCOB composite PMI eased slightly to 52.4 from 52.5, remaining above expectations and still in expansionary territory. Services firmed to an 18-month high of 53.1, while manufacturing slipped back below 50 to 49.7.

In the UK, annual CPI inflation slowed to 3.6% in October from 3.8%, supported by softer airfare, gas and utility prices. While marginally above consensus, the print reinforced expectations for a December rate cut. Core inflation eased to 3.4% from 3.5%, indicating further moderation in underlying pressures.

In Europe, the STOXX Europe 50 slipped 3.14% in local-currency terms as renewed caution around AI-related valuations and reduced expectations for a near-term U.S. rate cut weighed on sentiment. The FTSE 100 declined 1.64%.

Japan announces stimulus while China weighs support

Japan approved a JPY 21.3 trillion (USD 135 billion) stimulus package, marking progress toward the expansionary fiscal stance anticipated under new Prime Minister Sanae Takaichi. The measures include spending, targeted tax breaks and investment across areas such as shipbuilding and AI, aimed at supporting growth and easing pressure on households affected by elevated inflation.

In China, no major economic indicators were released during last week. However, policy developments were in focus as authorities reportedly consider additional measures to support the property market amid concerns that ongoing weakness could pose broader financial-stability risks.

Asian markets were similarly softer. Japan’s Nikkei 225 eased 3.48%, reflecting weakness in AI-linked technology names on valuation concerns. Mainland China’s Shanghai Composite fell 3.90%, while Hong Kong’s Hang Seng Index dropped 5.27%, mirroring the broader risk-off tone.

South African inflation steady as SARB cuts rate

South Africa’s latest CPI print showed inflation holding steady, with headline and core measures remaining broadly aligned with the SARB’s target range. According to Stats SA, headline CPI was 3.6% in October, slightly higher than in September but still in line with gradually easing price pressures.

Following the release, the SARB unanimously reduced the repo rate from 7.00% to 6.75% on Thursday, its first adjustment under the updated inflation-targeting framework. The MPC highlighted the improvement in the inflation backdrop but maintained a data-dependent approach.

During the week, the G20 meetings commenced, with discussions focusing on global growth, inflation dynamics and the broader policy outlook. The U.S. did not participate in this round of meetings, and discussions proceeded with the remaining members focusing on coordination efforts and broader global financial developments.

The JSE All-Share Index mirrored global peers, declining 2.08% over the week. Most sectors ended lower, with resources (-2.94%), industrials (-2.47%) and financials (-1.10%) all recording weekly losses. Property was the only positive performer, gaining 1.16%. Meanwhile, the rand depreciated 1.71% against the U.S. dollar, closing at R17.37 on Friday