Week in Review

In This Edition:

US data shows late-cycle resilience as Fed signals caution: US economic data remained mixed but constructive, with housing stabilising, labour conditions holding up and the Fed reinforcing a cautious, data-dependent easing path.

European growth cools as inflation eases unevenly: European data pointed to slowing momentum, with easing headline inflation, persistent core pressures and signs of strain in housing and labour markets.

Asia sends mixed signals as Japan normalises and China stabilises: Japan faced currency and yield pressures amid policy normalisation expectations, while China showed tentative manufacturing stabilisation supported by targeted long-term initiatives.

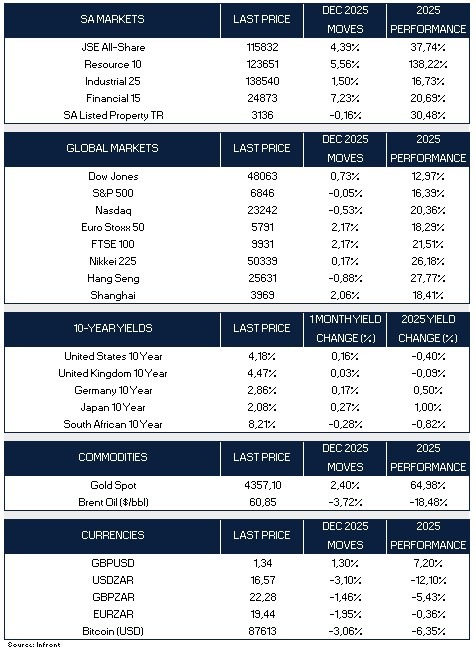

Global markets broaden as 2025 delivers strong but uneven returns: Equity gains broadened globally in 2025 beyond US technology, while bond markets reflected diverging monetary paths and shifting yield dynamics.

South Africa outperforms as resources rally and confidence improves: South African assets delivered standout returns in 2025, supported by a powerful resource rebound, a stronger rand and easing inflation and bond yields.

As we kick off 2026, we’d like to wish you a happy, healthy and prosperous year ahead. As always, we remain focused on helping investors navigate an evolving global landscape with discipline, perspective and a long-term mindset.

2025 reinforced an important lesson for investors: portfolios are rarely rewarded for reacting to political noise. Despite an almost constant stream of policy headlines, markets delivered robust returns, underscoring the value of staying invested and focused on fundamentals. Below, we highlight some of the key themes that shaped the year.

Key themes that shaped 2025

- Markets outperformed despite political noise: Strong returns across asset classes reinforced the importance of avoiding politically driven investment decisions.

- AI moved from promise to dominance: Breakthroughs in artificial intelligence reshaped industries, accelerated capital investment and emerged as a defining structural theme, with regulation lagging innovation.

- Trade tensions resurfaced: Aggressive tariff rhetoric, particularly between the U.S. and China, contributed to episodic volatility, despite temporary truces limiting near-term disruption.

- Geopolitical risks remained elevated: Conflicts across multiple regions heightened global uncertainty and influenced energy markets and investor sentiment.

- Volatility returned to markets: Global equities swung between a sharp pullback and record highs as technology shocks, trade risks and central bank uncertainty collided.

- Consumers showed selective resilience: Spending on entertainment and leisure remained firm despite tighter financial conditions.

- Climate risks moved into sharper focus: Extreme weather events highlighted growing economic, insurance and infrastructure risks.

- Property affordability deteriorated: Housing and rental markets continued to reprice higher globally, intensifying affordability pressures amid structural supply constraints and the lagged impact of higher interest rates.

US data shows late-cycle resilience as Fed signals caution

U.S. economic data over the holiday-shortened week presented a mixed but broadly constructive picture. Housing activity showed tentative signs of recovery, with pending home sales posting their strongest monthly gain since early 2023 as easing mortgage rates and solid wage growth improved affordability. House prices rebounded modestly in October, while year-on-year gains remained contained, suggesting price pressures are cooling rather than accelerating. Mortgage rates fell for a third consecutive week, ending 2025 at their lowest level of the year and beginning to draw buyers back after a subdued housing market.

Monetary policy remained a central focus following the release of minutes from the Federal Reserve’s December meeting. While the Fed delivered a 25 basis-point rate cut, policymakers struck a cautious tone, emphasising the need to balance easing inflation against lingering upside risks to prices and growing downside risks to employment. Markets reacted calmly, with investors continuing to price in a low probability of near-term rate cuts as the Fed maintains a data-dependent, wait-and-see approach.

Labour market signals were less clear-cut. Initial jobless claims fell to one of the lowest levels of the year, although seasonal distortions around the holidays likely contributed to volatility. Continuing claims also edged lower, pointing to limited immediate deterioration, even as broader indicators suggest hiring momentum has slowed through 2025 and the unemployment rate has risen to a four-year high. Manufacturing data echoed this late-cycle dynamic, with pockets of improvement in regional surveys offset by ongoing weakness in parts of the industrial sector.

European growth cools as inflation eases unevenly

Across Europe, data pointed to a gradual cooling in economic momentum. Spanish inflation eased further in December, driven by lower fuel prices, although core inflation remained sticky, reflecting persistent services pressures. France saw a modest improvement in registered unemployment on a month-on-month basis, but joblessness remains materially higher than a year ago. In the UK, house prices unexpectedly declined, highlighting ongoing affordability constraints, while Sweden’s central bank signalled a prolonged pause in policy rates through 2026 as it waits for inflation to normalise more convincingly.

Asia sends mixed signals as Japan normalises and China stabilises

In Asia, Japan and China offered contrasting signals. The Japanese yen remained under pressure near multi-year lows, fuelling speculation around potential official intervention, while government bond yields climbed to their highest levels since the late 1990s on expectations of gradual policy normalisation. In China, manufacturing activity stabilised, with the official PMI returning to expansion territory for the first time in eight months. While the improvement was modest, it supports expectations of a measured policy approach in 2026, complemented by longer-term initiatives such as Beijing’s new national venture capital fund aimed at fostering domestic innovation and technological self-sufficiency.

Global markets broaden as 2025 delivers strong but uneven returns

Global markets delivered a strong but increasingly differentiated performance in 2025, with equity returns broadening beyond the dominant U.S. technology trade. U.S. equities posted solid double-digit gains, led by the Nasdaq (+20.4%) and supported by a resilient S&P 500 (+16.4%), despite choppier conditions into year-end. Outside the U.S., returns were equally compelling: Japan’s Nikkei 225 surged 26.2% on improved corporate governance and yen dynamics, European equities ended the year firmly higher (Euro Stoxx 50 +18.3%, FTSE 100 +21.5%), while China and Hong Kong rebounded meaningfully after a weak start to the year. Bond markets reflected shifting monetary dynamics, with U.S. and UK 10-year yields ending the year modestly lower, German yields higher, and Japan’s 10-year yield rising sharply as expectations of policy normalisation intensified.

Global markets broaden as 2025 delivers strong but uneven returns

Global markets delivered a strong but increasingly differentiated performance in 2025, with equity returns broadening beyond the dominant U.S. technology trade. U.S. equities posted solid double-digit gains, led by the Nasdaq (+20.4%) and supported by a resilient S&P 500 (+16.4%), despite choppier conditions into year-end. Outside the U.S., returns were equally compelling: Japan’s Nikkei 225 surged 26.2% on improved corporate governance and yen dynamics, European equities ended the year firmly higher (Euro Stoxx 50 +18.3%, FTSE 100 +21.5%), while China and Hong Kong rebounded meaningfully after a weak start to the year. Bond markets reflected shifting monetary dynamics, with U.S. and UK 10-year yields ending the year modestly lower, German yields higher, and Japan’s 10-year yield rising sharply as expectations of policy normalisation intensified.

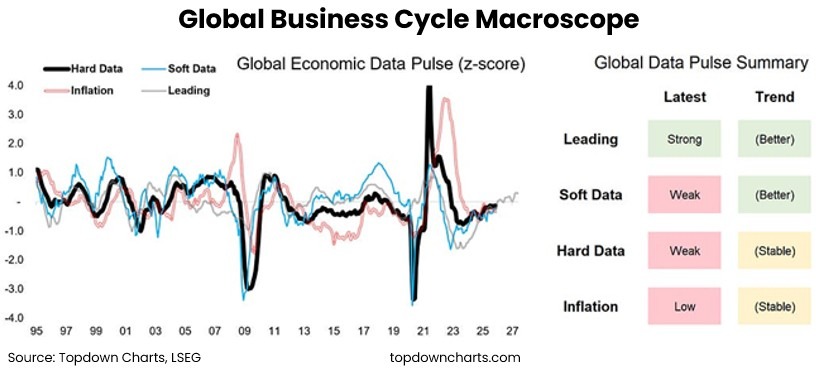

December capped a strong year across asset classes, but elevated valuations and relatively complacent sentiment into 2026 underscore the importance of disciplined asset allocation and risk management. As global monetary policy shifts from a headwind to a tailwind, with central banks easing amid contained inflation, the macro-outlook is best characterised by a balance between downside growth risks and the potential for renewed momentum, with the U.S. facing mixed late-cycle signals while Japan, Europe and China show signs of improving growth supported by policy stimulus. Source: Topdown Charts.